Risk appetite refers to the amount and type of risk your organisation is willing to accept in pursuit of their goals. Understanding your risk appetite is crucial in making informed decisions and achieving success in business or investing. While risk can be intimidating, it is also an essential part of growth and innovation. By understanding your appetite, you can strike a balance between risk and reward that aligns with your goals and values.

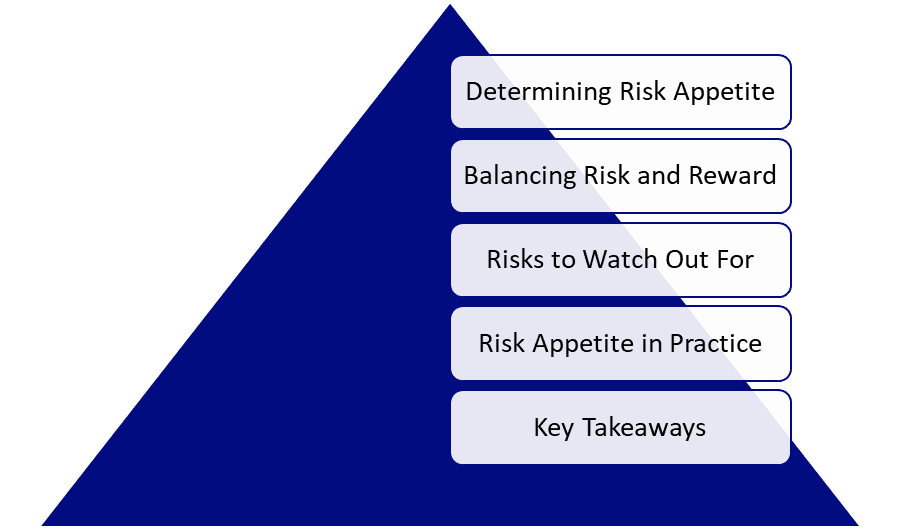

Determining Risk Appetite

Determining your risk appetite requires a thorough understanding of your financial goals, investment horizon, and risk tolerance. Your financial goals can be short-term or long-term, and your investment horizon can range from a few months to several years. These factors will determine the type of investments or businesses you are willing to consider and the level of risk you are willing to accept. Your risk tolerance is your emotional and psychological ability to handle risk. It varies from person to person and can depend on factors such as age, income, and experience. Once you have a clear understanding of these factors, you can determine your appetite and develop a risk management strategy that suits your needs.

When determining your risk appetite, it is also essential to consider your overall financial situation. For businesses, this includes factors such as revenue, expenses, debt, and capital structure. Understanding your financial situation will help you make realistic and achievable goals, which in turn will determine the level of risk that you are willing to take on. It is important to note that appetite is not a fixed concept and can change over time as your financial situation and goals evolve.

At The Risk Station, we offer tailored solutions for various industries and sub-industries that contain more than 50 key risk descriptions. These solutions can help businesses identify potential risks consider your overall financial situation. To learn more about our solutions, please check out our shop.

Balancing Risk and Reward

Balancing risk and reward is a fundamental concept in investing and business. The higher the risk, the higher the potential reward, but also the greater the potential loss. Therefore, it is essential to manage risk exposure within your risk appetite. One way to do this is by diversifying your investments or business activities. Diversification spreads your risk across multiple assets or areas, reducing your overall exposure to any one risk. Another way to manage risk is by setting clear investment or business objectives that align with your appetite. Please refer to the section Risk Mitigation Techniques: How to Reduce or Eliminate Risks on the Introduction to Risk Management Techniques article for further details on risk mitigation approaches. For example, if your risk appetite is low, you may prioritise stability and income generation over growth and capital appreciation.

To balance risk and reward effectively, it is also important to understand your business strategy. This includes understanding your competitive advantage, your target market, and your value proposition. By understanding your strategy, you can identify potential risks and opportunities and develop a risk management plan that aligns with your risk appetite. It is important to regularly review and adjust your risk management plan to reflect changes in your strategy or the market environment.

Risks to Watch Out For

Different types of businesses carry different levels of risk. For example, investing in stocks carries market risk, while investing in real estate carries operational and credit risks. Similarly, starting a new business carries operational and market risks, while acquiring an existing business carries financial and legal risks. It is crucial to understand these risks and how they may affect your investment or business performance.

Your risk appetite can help you mitigate risks by defining your risk tolerance and developing a risk management plan. For example, if your appetite is low, you may choose to invest in less volatile assets such as bonds or real estate. Alternatively, you may prioritise risk management strategies such as diversification or hedging to limit your exposure to market risks. On the other hand, if your risk appetite is high, you may be more willing to invest in high-growth, high-risk assets such as tech startups. In this case, you may prioritise risk-taking strategies such as venture capital or angel investing.

Risk Appetite in Practice

Real-life examples of risk appetite frameworks in business or investing can provide valuable insights into how appetite can inform decision-making. For example, a startup may develop a appetite framework to guide their investment decisions. The framework may include criteria such as the target return on investment, the level of risk exposure, and the timeline for exit. By defining these criteria, the startup can evaluate potential investments and make informed decisions that align with their risk appetite.

The benefits of risk appetite frameworks include improved decision-making, increased transparency, and better alignment with organisational goals. At The Risk Station, we understand the importance of having a comprehensive and effective appetite governance in place. We have seen first-hand how appetite frameworks can help organisations manage their risks and make informed decisions.

That’s why we offer a template of a Risk Appetite Policy Framework that can be tailored to the specific needs and requirements of your business. Our policy template includes key components such as appetite statements, risk categories and definitions, risk limits, risk management strategies, and monitoring and reporting procedures. By using our template, businesses can ensure that their risk appetite policy is thorough and effective in managing risks and aligning with their overall business goals.

Risk and Reward – Key Takeaways:

Determining and managing your risk appetite is a crucial part of achieving your financial or business goals. By understanding the types of risks you may face, identifying your risk tolerance and financial situation, and developing a risk management plan, you can strike a balance between risk and reward that aligns with your goals and values. Balancing risk and reward effectively requires a long-term perspective, a clear understanding of your strategy, and a focus on achieving your long-term goals.

In summary, appetite is a critical factor in decision-making for organisations. By understanding the risks associated with your businesses, and by using risk appetite frameworks to guide decision-making, you can mitigate risks and avoid potential pitfalls. Ultimately, managing risk is about balancing risk and reward, and doing so effectively requires a deep understanding of your financial situation, your goals, and your risk tolerance.