As we approach the end of 2023, businesses across all industries are embarking on the process of preparing their risk management and internal audit plans for risks 2024 of the year ahead. This is a crucial step in ensuring that businesses are adequately equipped to address the evolving risk landscape and seize emerging opportunities.

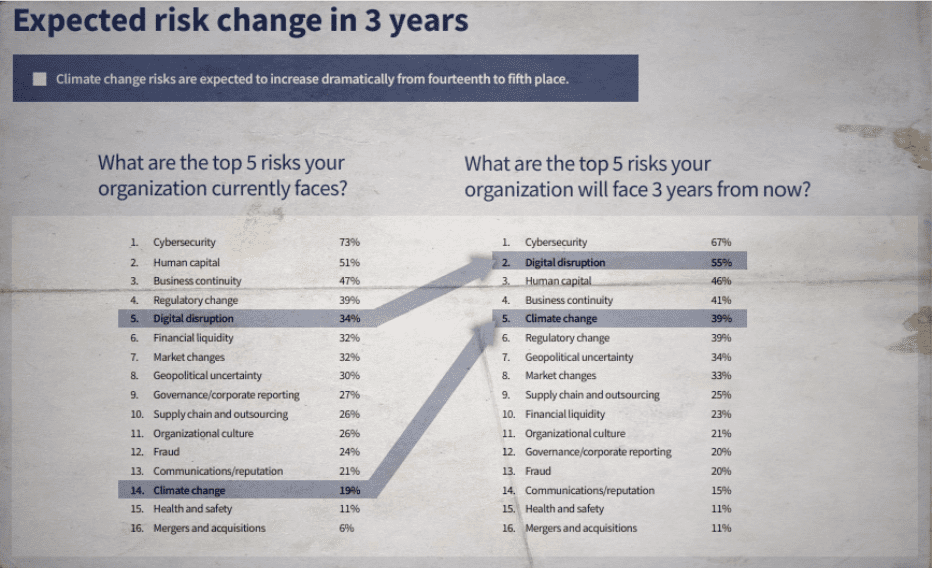

Drawing insights from the Institute of Internal Auditors (IIA) Risk in Focus annual report on risk and audit topics, professionals in risk management are afforded valuable perspectives for the upcoming year. The report highlights pivotal trends anticipated to impact organisations in 2024, anchoring the foundation for comprehensive risk management strategies discussed througout the 2023 on The Risk Station:

- The increasing prevalence of cyber threats and the need for robust cybersecurity measures. Stressed in numerous times on The Risk Station.

- The growing importance of governance and corporate reporting in ensuring transparency and accountability

- The challenges and opportunities associated with human capital management, particularly in the context of a changing workforce

- The need for effective business continuity planning to mitigate disruptions and enhance resilience

- The importance of organisational culture in fostering a risk-aware and ethical environment

- The impact of regulatory changes on risk management practices

- The transformative power of digital disruption and the need to adapt risk management strategies accordingly

- The challenges of financial liquidity in an uncertain economic environment

- The growing significance of communications and reputational risk management

- The complexities of fraud detection and prevention in an increasingly complex business environment

- The importance of health and safety risk management in a post-pandemic world

- The need to address the growing risks posed by climate change

- The evolving landscape of supply chain and outsourcing arrangements and their impact on risk management

- The challenges and opportunities associated with market changes

- The complexities of managing geopolitical uncertainty

- The increasing prevalence of mergers and acquisitions and the need for robust integration risk management

Key Risks for 2024

As we stand on the precipice of risks 2024, the landscape of risk for organisations is more complex and dynamic than ever before. In the pursuit of sustainable success, businesses must not only identify potential challenges but also proactively develop strategies to navigate and mitigate these risks. The following table provides an in-depth exploration of the diverse array of risks that organisations are likely to face in 2024:

Summary table

| Risk Category | Description |

| Cybersecurity | Continued cyber threats persist, encompassing ransomware attacks, data breaches, and supply chain infiltrations. Vigilant cybersecurity measures are imperative to safeguard sensitive information and ensure business continuity. |

| Governance/Corporate Reporting | The challenge lies in maintaining transparency and accountability amidst complex regulatory requirements and evolving stakeholder expectations. Organisations must navigate these intricacies to build and retain trust among stakeholders. |

| Human Capital | In a highly competitive talent market, the emphasis is on attracting, retaining, and developing a skilled workforce. Effective human capital management is paramount for organisational growth and success. |

| Business Continuity | Organisations must be prepared to face and respond to disruptive events, ranging from natural disasters and cyberattacks to supply chain disruptions. Robust business continuity planning is essential for resilience and recovery. |

| Organisational Culture | The focus is on fostering a risk-aware and ethical culture that promotes responsible decision-making and mitigates misconduct. Cultivating a positive organisational culture contributes to long-term success and stakeholder trust. |

| Regulatory Change | The challenge involves adapting risk management practices to align with the ever-evolving landscape of regulatory requirements. Flexibility and agility are key to ensuring compliance while navigating the complexities of regulatory changes. |

| Digital Disruption | Navigating the transformative power of digital technologies requires a delicate balance between embracing innovation and ensuring cybersecurity and data privacy. Organisations must adapt their risk management strategies to this evolving digital landscape. |

| Financial Liquidity | In an uncertain economic environment, effective financial risk management is crucial for organisational stability. Strategies for managing liquidity risks and financial uncertainties are vital components of a comprehensive risk mitigation plan. |

| Communications/Reputation | Protecting and enhancing reputation in the face of increased scrutiny and public awareness demands meticulous communication and reputational risk management. Organisations must be proactive in managing their public image. |

| Fraud | The complex and ever-changing business environment presents challenges in detecting and preventing fraud schemes. Robust fraud detection and prevention strategies are essential to safeguard organisational assets and maintain integrity. |

| Health and Safety | Ensuring workplace safety and protecting employees from health and safety hazards are paramount, especially in the post-pandemic world. Organisations must prioritise health and safety risk management to create a secure working environment. |

| Climate Change | Adapting to the impacts of climate change and mitigating climate-related risks have become central concerns for risk management. Organisations need to incorporate sustainable practices and resilience strategies to address environmental challenges. |

| Supply Chain and Outsourcing | Managing risks associated with global supply chains and outsourcing arrangements is critical for ensuring operational resilience. Organisations must anticipate and address potential disruptions to maintain the flow of goods and services. |

| Market Changes | Anticipating and adapting to shifts in market conditions and customer preferences is essential for sustaining competitiveness. Organisations need to be agile in responding to market changes to ensure continued relevance and success. |

| Geopolitical Uncertainty | Preparing for and responding to geopolitical events and their potential impact on business operations require strategic foresight. Organisations must incorporate geopolitical risk management into their plans to navigate uncertainties effectively. |

| Mergers and Acquisitions | Seamlessly integrating acquisitions and managing integration-related risks are crucial for successful mergers and acquisitions. Organisations must employ robust risk management strategies to ensure a smooth transition and maximise value creation. |

Conclusion

As organisations gear up for the challenges of 2024, careful consideration of the evolving risk landscape is paramount. In this intricate tapestry of risks, organisations are called upon to not only recognise the challenges ahead but to embrace them as opportunities for growth and resilience. By delving into the nuances of each risk category, businesses can tailor their risk management and internal audit plans to effectively safeguard their interests and propel themselves toward sustainable success in the coming year.

The Risk Station´s tools at your disposal, encompassing advanced risk identification and mitigation strategies, position organisations to not only navigate challenges but also thrive in an ever-evolving business environment.